Real Option Valuation 2.1

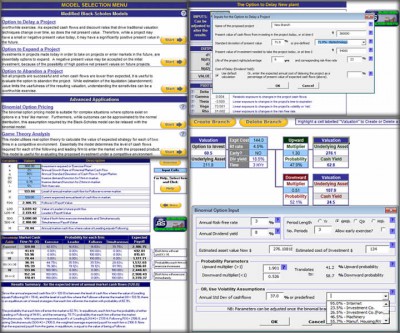

The Real Option Valuation model encompasses a suite of option pricing tools to quantify the embedded strategic value for a range of financial analysis and investment scenarios.

The Real Option Valuation model encompasses a suite of option pricing tools to quantify the embedded strategic value for a range of financial analysis and investment scenarios.

|

The Real Option Valuation model encompasses a suite of option pricing tools to quantify the embedded strategic value for a range of financial analysis and investment scenarios.

Traditional discounted cash flow investment analysis will only accept an investment if the returns on the project exceed the hurdle rate. While this is a worthwhile exercise, it fails to consider the myriad of strategic options that are associated with many investments.

This model provides the ability to identify what options might exist in your proposal and the tools to estimate the quantification of them.

The key features of this model include: Ease and flexibility of input, with embedded help prompts; Informative 'Quick Start' menu for choosing the correct tool for the situation; Modified Black Scholes models to value the options to delay, expand, or abandon investments;

Automatic binomial 'tree' builder model to evaluate complex strategic options with multiple stages; Nash equilibrium Game Theory model to evaluate market entry strategies in a competitive environment; and Ability to predefine historical investment and/or industry risk profiles to utilize across models.

tags![]() this model strategic options

this model strategic options

Download Real Option Valuation 2.1

![]() Download Real Option Valuation 2.1

Download Real Option Valuation 2.1

Purchase: ![]() Buy Real Option Valuation 2.1

Buy Real Option Valuation 2.1

Similar software

Real Option Valuation 2.1

Real Option Valuation 2.1

Excel Business Tools

The Real Option Valuation model encompasses a suite of option pricing tools to quantify the embedded strategic value for a range of financial analysis and investment scenarios.

Portfolio Performance Monitoring 2.0

Portfolio Performance Monitoring 2.0

Excel Business Tools

The Portfolio Performance Monitoring model enables the ongoing monitoring and periodic valuation of a portfolio of financial investments.

Investment and Business Valuation 3.2

Investment and Business Valuation 3.2

Excel Business Tools

The Investment and Business Valuation template is ideal for evaluating a wide range of investment, financial analysis and business case scenarios.

Portfolio Optimization 5.2

Portfolio Optimization 5.2

Excel Business Tools

The Portfolio Optimization model calculates the optimal capital weightings for a basket of financial investments that gives the highest return for the least risk.

Model Analyzer for Excel 1.0

Model Analyzer for Excel 1.0

Jabsoft

With Model Analyzer for Excel you'll be able to build, analyze and manage multiple scenarios to any model in due time and without needing to change the logic of your models.

Investment Analysis Software 10

Investment Analysis Software 10

Bizpep

Investment Analysis Software provides the capacity to easily analyze the performance of any investment.

Business Valuation Model Excel 60

Business Valuation Model Excel 60

Bizpep

The Business Valuation Model Excel combines relative indicators for future performance with basic financial data (Revenue, Variable and Fixed Costs) to value the business.

Investment Wizard 1.07

Investment Wizard 1.07

The Other Software Company

Investment Wizard is a useful and powerful financial calculator for long-term investment planning.

Decision Assistant Model Excel 50

Decision Assistant Model Excel 50

Bizpep

The Decision Assistant Model Excel allows you to value a decision and determine the impact on your business.

SigmaFit 2.0

SigmaFit 2.0

Scinance Analytics

SigmaFit application is based on the author's novel exact solutions (YM_SV) of the Stochastic Volatility (SV) Option Problems.