Portfolio Performance Monitoring 2.0

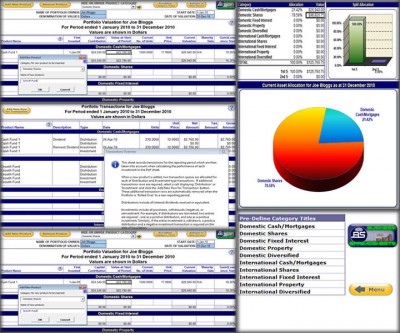

The Portfolio Performance Monitoring model enables the ongoing monitoring and periodic valuation of a portfolio of financial investments.

The Portfolio Performance Monitoring model enables the ongoing monitoring and periodic valuation of a portfolio of financial investments.

|

The Portfolio Performance Monitoring model enables the ongoing monitoring and periodic valuation of a portfolio of financial investments.

The model allows the entering of investment transactions during a reporting period to calculate performance. Furthermore, incremental investment transactions undertaken during a period are fully accounted for in the period's performance calculations.

Roll over of the model and archiving of transactions make this model ideal for monitoring your portfolio on an ongoing basis.

The key features of the Portfolio Performance Monitoring model include: Ease and flexibility of product and transaction input, with embedded help prompts; Accurate handling of distributions, investments, and divestments to calculate returns. 'Rollover' option to reset the model for a new reporting period; and Storage of historical transactions.

tags![]() the model investment transactions reporting period monitoring model portfolio performance performance monitoring the portfolio

the model investment transactions reporting period monitoring model portfolio performance performance monitoring the portfolio

Download Portfolio Performance Monitoring 2.0

![]() Download Portfolio Performance Monitoring 2.0

Download Portfolio Performance Monitoring 2.0

Purchase: ![]() Buy Portfolio Performance Monitoring 2.0

Buy Portfolio Performance Monitoring 2.0

Similar software

Portfolio Performance Monitoring 2.0

Portfolio Performance Monitoring 2.0

Excel Business Tools

The Portfolio Performance Monitoring model enables the ongoing monitoring and periodic valuation of a portfolio of financial investments.

Portfolio Optimization 5.2

Portfolio Optimization 5.2

Excel Business Tools

The Portfolio Optimization model calculates the optimal capital weightings for a basket of financial investments that gives the highest return for the least risk.

Real Option Valuation 2.1

Real Option Valuation 2.1

Excel Business Tools

The Real Option Valuation model encompasses a suite of option pricing tools to quantify the embedded strategic value for a range of financial analysis and investment scenarios.

Business Valuation Model Excel 60

Business Valuation Model Excel 60

Bizpep

The Business Valuation Model Excel combines relative indicators for future performance with basic financial data (Revenue, Variable and Fixed Costs) to value the business.

Investment Analysis Software 10

Investment Analysis Software 10

Bizpep

Investment Analysis Software provides the capacity to easily analyze the performance of any investment.

Portfolio Calculator 2.1.1

Portfolio Calculator 2.1.1

Paul Farley

PCal allows you to calculate and record financial measures such as Value at Risk, Volatility, loss/gain and investment value changes of a portfolio composition consisting of 5 assets (stocks) in corporations either in European or U.

Investment Wizard 1.07

Investment Wizard 1.07

The Other Software Company

Investment Wizard is a useful and powerful financial calculator for long-term investment planning.

Investment Growth RateCalculator 2.0.0

Investment Growth RateCalculator 2.0.0

Vidyasoft Applications

Investment Growth RateCalculator is created to calculate the compound interest rate based on dates of all your previous investments and the current balance

By knowing the growth rates for different periods of time, you may decide to fine-tune your investment strategy.

.jpg) WebCab Portfolio (J2SE Edition) 5.0

WebCab Portfolio (J2SE Edition) 5.0

WebCab Components

Apply the Markowitz Theory and Capital Asset Pricing Model (CAPM) to analyze and construct the optimal portfolio with/without asset weight constraints with respect to Markowitz Theory by giving the risk, return or investors utility function; or with respect to CAPM by given the risk, return or Market Portfolio weighting.

RealReturns 1.0

RealReturns 1.0

Brandotech, LLC

Precisely Determine Results of your investments

RealReturns software will calculate investment returns using a variation of the concept known as ‘Compound annual growth rate’ (CAGR).