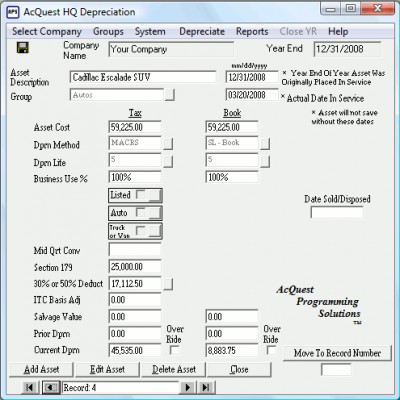

AcQuest HQ Depreciation 2.53

HQ Depreciation is a program that simultaneously calculates and keeps records of federal and GAAP depreciations.

HQ Depreciation is a program that simultaneously calculates and keeps records of federal and GAAP depreciations.

|

HQ Depreciation is a program that simultaneously calculates and keeps records of federal and GAAP depreciations.

AcQuest HQ Depreciation features

tags![]() demo version straight line and gaap federal and

demo version straight line and gaap federal and

Download AcQuest HQ Depreciation 2.53

![]() Download AcQuest HQ Depreciation 2.53

Download AcQuest HQ Depreciation 2.53

Purchase: ![]() Buy AcQuest HQ Depreciation 2.53

Buy AcQuest HQ Depreciation 2.53

Similar software

AcQuest HQ Depreciation 2.53

AcQuest HQ Depreciation 2.53

AcQuest Programming Solutions

HQ Depreciation is a program that simultaneously calculates and keeps records of federal and GAAP depreciations.

AcQuest Pro Depreciation 5.35

AcQuest Pro Depreciation 5.35

AcQuest Programming Solutions

AcQuest Pro Depreciation is designed to run on Windows 95, 98, Me, & XP.

TVPX 1031 Depreciation Solution 3.0

TVPX 1031 Depreciation Solution 3.0

Time Value Property Exchange

TVPX 1031 Depreciation Solution is an extremely easy way to calculate Federal and book depreciation.

Depreciation 4562 Pro 1.5

Depreciation 4562 Pro 1.5

Microtechware

Depreciation 4562 Pro is a complete fixed asset software which includes book and tax depreciation, management reporting.

Bassets Depreciation Calculator 1.3

Bassets Depreciation Calculator 1.3

Decision Support technology

The Bassets Depreciation Calculator is a useful and powerful stand-alone software program which you can download to your Desktop.

AssetManage 2005

AssetManage 2005

Liberty Street Software

AssetManage can be used to keep track of your company and personal assets.

AcQuest 1065 Solution 1.05

AcQuest 1065 Solution 1.05

AcQuest Programming Solutions

The 1065 Solution is created to be used to prepare the four primary pages, depreciation calculations, K-1s, supporting detail sub-schedules, and some of the common forms associated with federal Form 1065, U.

AcQuest 1120 Solution 1.03

AcQuest 1120 Solution 1.03

AcQuest Programming Solutions

The 1120 Solution is an application that prepares a basic Form 1120, the supporting detail sub-schedules, depreciation calculations, and some of the common associated forms of federal Form 1120, U.

CalcPac RPN 1.50

CalcPac RPN 1.50

MindVision Software

CalcPac RPN is an powerful business calculator that can handle hundreds of business uses.

AcQuest California 100 Solution 1.01

AcQuest California 100 Solution 1.01

AcQuest Programming Solutions

The 100 Solution is a program that will prepare a basic Form 100, the supporting detail sub-schedules, depreciation calculations, and some of the common associated forms of Form 100, California Corporation Franchise or Income Tax Return.